Factoring of accounts receivable is often a fast, and flexible way for businesses to finance their growth.

It is particularly useful in accelerating cash flows to generate working capital and getting over a near term liquidity hump. However, in some circumstances selling accounts receivable may not be the best financing option for a business owner.

When does that happen?

Let’s take a look at some of the situations.

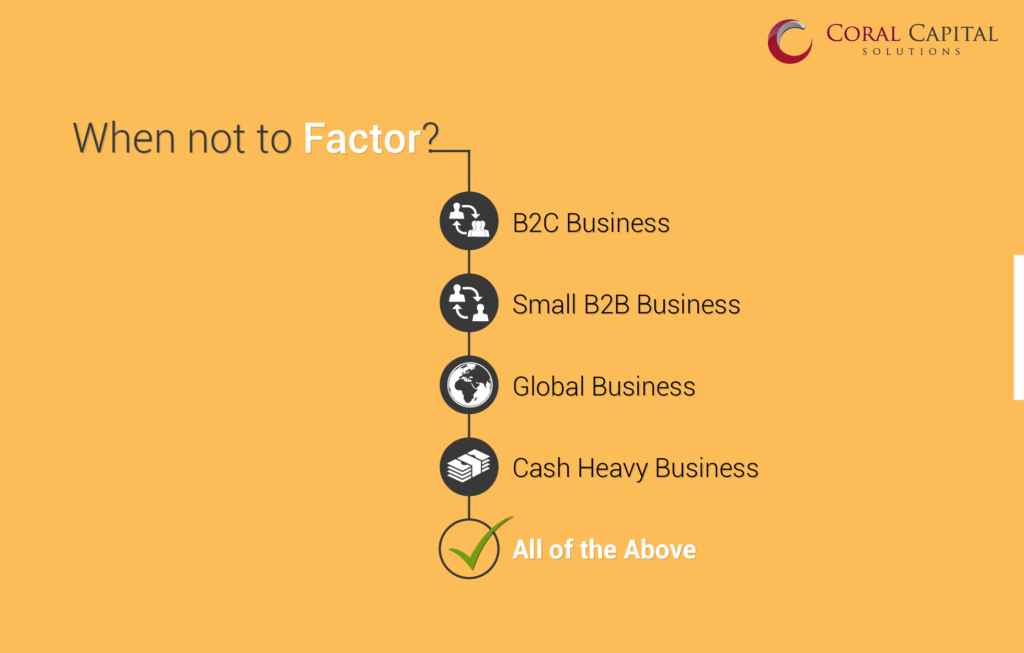

When a company sells directly to consumers, be it a brick and mortar establishment such as a supermarket or an online retailer, revenues are collected in cash or credit card receipts. There is generally no outstanding receivable.

Even if such a business was selling goods on credit and getting paid later, consumer receivables are generally not something a factor can finance.

Even if a business is B2B i.e. it sells to other businesses and has outstanding invoices that are unpaid, it may not be a good fit for factoring if all its customers are very small and of indeterminate creditworthiness.

For instance, a dairy selling milk to a hundred bodegas, or a fashion label that does not yet have distribution at major retailers and is primarily selling to small independent stores. A factoring transaction generally only works because the financier is able to count on the creditworthiness of business’ customers in order to monetize invoices for the business owner.

If the customers are small or not creditworthy then the factor can no longer place reliance on their strength in order to support their vendor’s financing.

Check out the Industries we Finance

Factoring is a rather specialized type of financing with nuanced documentation and operational requirements that vary substantially by jurisdiction.

A consequence of this is that it also tends to be a localized business. Most factors are only financing receivables that are domestic or close to domestic. For example we generally only entertain transactions where the customers paying on invoices are US or Canadian companies paying in USD or CAD.

Although there are a small number of factors that are willing to look at transactions with international invoices, they also mostly focus on a handful of geographies.

Certain industries exhibit a bias for cash transactions or for informal dealings that are not well documented and hard to for a third party to verify. In such situations it is challenging for a factor to do adequate diligence and provide financing.

The fine jewelry business would be one such industry where many companies still transact on handshakes and payments often involve the exchange of cash.

Due to nuances in the laws that cover priorities of security interests collateral, some businesses are a poor fit for factoring. Just like a lender on a home or auto needs to have a first lien on the asset in order to provide their loan, a factor also needs to have a senior security interest in the invoices financed.

In some situations, this seniority of the lien is in question because of specific laws designed to protect certain constituencies. For example, if a business owner buys and resells fresh produce (covered by PACA laws granting special rights and liens to farmers) then her invoices would be challenging to finance.

Similar issues exist in financing construction receivables where there is a chance of collateral being encumbered by mechanics liens.

Do you know of any other situation where Accounts Receivable Financing is not applicable? Please feel free to reach out.